The Great Housing Debate: ROAD to Housing or a Dead End?

The Great Housing Debate: ROAD to Housing or a Dead End?

JaxBNimble: Welcome to JaxBNimble's first mock debate. In it an AI-assisted attempt of a Democratic Capitalist to imagine a middle ground between what are often oversimplified as irreconcilable differences. This one concerns the US housing crisis, which is obvious enough to get unanimous passage of the ROAD to Housing Act (S. 2651) in the Senate, yet sits stalled in the House. On one side, the mock debate is positions we ascribe to Matt Yglesias, whose Slow Boring website often builds on his 2012 book, The Rent is Too Damn High. The other is views we ascribe to Professor David Jaffee, who founded and directs the JAX Rental Housing Project, a UNF community-based research project. What follows is, then, just a "based-on-fact docudrama", not necessarily anything either individual has said or would necessarily endorse. Is is all JaxBNimble artifact.

We offer this lengthy "interview" because we are looking at a pivotal moment. The ROAD Act proposes 40 provisions—from streamlining zoning to expanding manufactured housing. To those those looking for a way forward in Jacksonville, the question is: Does this act actually address the "Florida Dream," or is it just a subsidy for the status quo?

Round 1: The Supply vs. Financialization Trap

Matthew Yglesias: Let's be honest: the ROAD Act is exactly what a market needs. It targets the "Regulatory Barriers" (Title II) that make building new homes in Jax expensive. It creates an Innovation Fund to reward cities that modernize zoning. If we don't pass this, we're just choosing to keep supply low, which is the only reason corporate landlords have "pricing power" in the first place. High supply is the investor's kryptonite.

Dr. David Jaffee: That is a classic Yglesias oversimplification. I'm looking at the "Accountability" sections of the ROAD Act, and I see a lot of oversight for HUD, but almost none for the Private Equity firms that bought 30% of Jacksonville's starter homes last year. Matt, if we "modernize zoning" and build more duplexes, but an out-of-state REIT buys the entire block with cash before a local family can even see the listing, how does the ROAD Act help the citizen?

Matthew Yglesias: It helps because any new unit reduces the pressure on the existing stock. But I take your point on speed. Even I can admit that a family with a 30-day mortgage approval process can't compete with a "buy-all" algorithm.

Round 2: The "Homeowner Ladder" & Local Arcana

JaxBNimble: Matt, you've hit on the friction point. In our Strategic Alliance Matrix, we talk about a "Homeowner Ladder" ordinance. If the ROAD Act provides the "Carrot" (federal grants), can we use local "Sticks" to fix that competition gap?

Dr. David Jaffee: Exactly. We need a "Community-First" window. If a house in Springfield or Riverside goes for sale, give local residents a 30-day exclusive "Right to Bid."

Matthew Yglesias: (Provocatively) A "Right to Bid" sounds like a market distortion, David. But, if we framed it as a "Tax Survival Plan" for those investors—where they get to avoid aggressive new state-level taxes by agreeing to stay out of the "starter home" tier—I could see a path. We use the ROAD Act's Whole-Home Repairs grants to help the residents fix those houses up, while steering the big institutional money toward the large-scale Build-to-Rent density projects that the ROAD Act's zoning reforms would finally make legal.

Round 3: The Strategic Alliance Matrix

JaxBNimble: This is where the synthesis happens. We have five stakeholder groups. How does the ROAD Act engage them through our Matrix?

Dr. David Jaffee: For the Local Officials (Hicks/Peluso), the ROAD Act is a funding source. But they need a "Matrix" to ensure that money isn't just a gift to developers. They need the Citizen's Guide to explain why we are prioritizing local ownership over high-yield extraction.

Matthew Yglesias: And for the Institutional Investors, the ROAD Act offers "Regulatory Certainty." The Matrix adds the missing piece: "Community Consent." We are telling the REITs: "You can build big in Jax (Supply), but you have to stop cannibalizing the first-time buyer market (The Ladder)."

The Dialogue: What Comes After the ROAD Act?

JaxBNimble: The ROAD Act is a historic bipartisan achievement, but as we've seen, it stalled in the House. Even if it passes tomorrow, it's a "foundation," not the whole house. So, what should citizens ask this new Congress to do next? What initiatives might a 2026 Congress take that go beyond just "cutting red tape"?

Q1: The "Financialization Fee" & The Starter Home Shield

Dr. Jaffee: The first thing citizens should demand is a limit on the "hoarding" of existing stock. The ROAD Act is great at helping people build new units, but it doesn't stop a private equity firm from buying up an entire block of 1950s bungalows in Jax.

"I'd push Congress for a Federal Stamp Duty—a high tax on any institutional investor buying a single-family home that has been on the market for less than 30 days. We need to create a 'First Look' window for families that is backed by the IRS, not just a local suggestion."

Matthew Yglesias: (Provocatively) A new tax is a heavy lift, David. But I'll meet you halfway. Instead of just taxing the "bad" behavior, why not incentivize the "good"?

"Citizens should ask for a 'Homeowner Ladder' Capital Gains Credit. If a seller chooses an owner-occupant or a first-time homebuyer over an all-cash corporate bid, they should get a 50% reduction in their capital gains tax on that sale. Let's make it more profitable for a retiree in Mandarin to sell to a young family than to a REIT."

Q2: Modernizing the "HUD Code" for the 21st Century

JaxBNimble: Matt, you often talk about the "arcana" of construction. Is there a Congressional lever there?

Matthew Yglesias: Absolutely. The ROAD Act starts to address Manufactured Housing, but Congress needs to go further. We should demand a national "Right to Build ADUs" (Accessory Dwelling Units). Congress could tie federal highway or transit funds to a requirement that cities allow "backyard cottages" by-right. This isn't just supply; it's a wealth-builder for the existing homeowner who can now rent out their garage to a teacher or nurse.

Dr. Jaffee: I'd add a caveat: that "Right to Build" must be paired with Tenant Protection Standards. If the federal government is going to incentivize ADUs, those units should be subject to a national "Fair Rent" registry so we can track if they are actually staying affordable or just becoming short-term vacation rentals.

Q3: The "Safe Harbor" for Institutional Capital

JaxBNimble: This brings us back to our Strategic Alliance Matrix. How do we frame these "asks" so they don't just trigger a lobbying war from Wall Street?

Matthew Yglesias: We offer the Safe Harbor. We tell Congress to create a "Two-Tiered Investment Framework."

- Tier 1 (Pro-Supply): If you invest in high-density, Build-to-Rent multi-family projects, you get accelerated depreciation and federal backing.

- Tier 2 (The Shield): If you buy existing single-family "starter" stock, you lose those tax benefits.

"It's a clear market signal: 'Build up, don't buy out.'"

JaxBNimble: We've explored the ROAD Act and the "Homeowner Ladder." Now, let's address the elephant in the room: The Institutional Investor. Many see them as a monolith of resistance. But in 2026, the political winds are shifting. Between potential "Wealth Taxes" on housing hoarding and local crackdowns on LLC anonymity, many firms are looking for an exit strategy—or at least a "survival" strategy.

Matthew Yglesias: Exactly. If I'm a REIT (Real Estate Investment Trust) right now, I'm seeing a "K-shaped" regulatory environment. In some states, they are talking about outright bans on corporate ownership. That is a nightmare for a portfolio's long-term stability. The Tax Survival Plan isn't just about paying fewer taxes; it's about Regulatory Peace.

"Investors want to know where they can safely deploy capital for 20 years. If the 'Middle Ground' says: 'You can have zero friction if you build new density (Build-to-Rent), but you'll face massive friction if you buy existing starter homes,' most rational funds will take that trade-off. It's better to have a guaranteed 5% return in BTR than a risky 8% return in single-family stock that might get taxed into oblivion by a Citizen Initiative."

Dr. Jaffee: (Nodding cautiously) I'm skeptical of corporate benevolence, but I'm a fan of incentives that change behavior. If we can pivot that Wall Street capital away from our historic neighborhoods and toward vacant transit corridors, we win twice.

"In Jacksonville, we have thousands of acres of underutilized land. If the City Council says to these firms: 'We will give you a Safe Harbor from our new Landlord Registry and a 10-year property tax abatement if—and only if—you are adding net-new units to the city's inventory,' then the financialization of housing finally starts to work for us instead of against us."

Q: How does this bring the State Legislature into focus?

JaxBNimble: This is the "arcana" of Florida law. Florida's "Live Local Act" already set the stage for state-preempted zoning for affordable housing.

"A 2026 Congress or State Legislature could expand this by creating a 'Qualified Housing Opportunity Zone.' If an institutional investor puts money into these zones—specifically for new construction—they get federal and state tax deferments. But if they buy a house outside that zone in a 'protected' residential area, they lose their 'Pass-Through' status as a REIT. That's the ultimate stick. It hits their bottom line where it hurts most."

Matthew Yglesias: And that's why they won't fight it. A REIT's entire value proposition is its tax-advantaged status. If you threaten that status for "hoarding" existing homes but protect it for "building" new ones, they will pivot their business model overnight.

The Dialogue: Activating the Local "Gears"

JaxBNimble: We've discussed the federal "engine" (the ROAD Act) and the "Tax Survival Plan" for big capital. But housing is lived at the neighborhood level. In Jacksonville, Joshua Hicks is building transparency dashboards, and Jimmy Peluso is pushing to turn vacant, city-owned lots into homes.

Gentlemen, what is the proactive role for a County-City government that goes beyond just "managing" the crisis?

Q1: The "Land as Leverage" Strategy

Matthew Yglesias: The most proactive thing Joshua Hicks can do—and he's already starting—is to treat city-owned land as a strategic asset, not a liability. Peluso's proposal to turn vacant lots in 32206 into affordable homes is a perfect example.

"If the city owns the dirt, they own the terms. They should tell developers: 'We'll give you this land for $1, but you must build a duplex where the owner lives in one side and rents the other at a capped rate.' This creates 'Missing Middle' supply without needing a billion-dollar federal check."

Dr. Jaffee: (Interjecting) I agree with the land use, but Peluso and Hicks have a bigger fight. The 2026 budget saw millions in housing funds cut by the Council Finance Committee. To be proactive, they need to build a Community Land Trust (CLT).

"By moving city land into a CLT, we take it out of the speculative market forever. It stops being a target for an out-of-state REIT. Joshua Hicks needs to move from 'Downpayment Assistance' (which just inflates prices) to 'Permanent Affordability' through the CLT model. That is how you protect District 7 from being bought out from under its residents."

Q2: The "Permit Fast-Pass" as a Trade-Off

JaxBNimble: Peluso is in a tough spot. He wants density, but he also represents historic neighborhoods like Springfield. How does he balance that "arcana" of zoning?

Matthew Yglesias: He should use the "Permit Fast-Pass." Right now, 97% of developers complain about permitting delays.

"If Peluso passes an ordinance that grants 24-hour administrative approval for any project that follows the 'Homeowner Ladder'—meaning it's built for an owner-occupant—he creates a massive market advantage for local builders. You don't need a tax break if you can save a builder six months of interest payments on their loan."

Dr. Jaffee: And that "Fast-Pass" should be the "Sticker" for our Tax Survival Plan. We tell the institutional investors: "You want that 24-hour approval? Fine. But you only get it if you are building in the 'Build-to-Rent' zones on the Northbank. You stay out of the historic core."

Q3: The "Citizen Initiative" as the Final Lever

JaxBNimble: Finally, if the City Council continues to cut the housing budget—as we saw in the $13 million spending reduction this past year—what is the "Nuclear Option"?

Dr. Jaffee: The Citizen Initiative. Florida's constitution allows for local referendums. If the representatives won't fund the "Ladder," the citizens can vote to mandate a Housing Trust Fund through a dedicated portion of the property tax.

Matthew Yglesias: And if I'm an investor, I'd much rather work with Peluso on a "Safe Harbor" deal now than face a 60% voter-mandated tax hike in November. That is the ultimate leverage of the Strategic Alliance.

The Dialogue: The Tallahassee Power Play

JaxBNimble: Gentlemen, as of early 2026, the Florida House has pre-filed a slate of eight property tax amendments (HJR 201 through HJR 213). They aren't just "trimming the edges"—they are discussing the total elimination of non-school homestead property taxes. Meanwhile, the Live Local Act continues to preempt local zoning.

What is the "arcana" that citizens need to understand about this state-level squeeze?

Q1: The Preemption Trap vs. The Missing Middle

Matthew Yglesias: The arcana everyone misses is that the State is effectively "force-feeding" density. The 2025/2026 amendments to the Live Local Act (SB 1730) now require local governments to administratively approve "Missing Middle" housing—duplexes and townhomes—without a single public hearing.

"This is the ultimate 'YIMBY' dream, but it's a nightmare for local control. The state is saying: 'If you won't build it, we'll take away your right to say no.' For Jacksonville, this means developers can now bypass the City Council entirely if they include 40% affordable units."

Dr. Jaffee: And that is exactly where the Ownership Crisis gets worse. The State is giving developers these massive density bonuses and tax exemptions, but they aren't requiring them to sell to people.

"Tallahassee is creating a 'Corporate Haven.' Under the new 2026 rules, a developer can build a 70-unit project on state-owned land and get a 100% tax exemption (H0797). If that project is owned by a private equity fund, the city of Jacksonville loses the tax revenue AND the residents lose the chance at homeownership. We are subsidizing our own displacement."

The "Death of the Property Tax" and the Budget Cliff

JaxBNimble: Let's talk about the Tax Amendments. Speaker Perez and the House Ways & Means Committee are pushing HJR 201, which would eliminate property taxes for homesteads. How does this impact the "Middle Ground"?

Matthew Yglesias: This is the "stick" I mentioned earlier. If HJR 201 passes, cities like Jax lose billions. State leaders are using this to force local governments to cut "wasteful spending."

"The arcana here is the 60% Threshold. These are constitutional amendments. If they get on the ballot in November 2026, and 60% of Floridians vote 'Yes' because they want a tax break, Jacksonville's ability to fund police, fire, and the 'Homeowner Ladder' evaporates. The city is being forced into a 'Safe Harbor' agreement with the state before the voters take the money away."

Dr. Jaffee: It's a manufactured crisis. They are starving the cities to force them to accept corporate-friendly zoning. But there is a counter-move: HJR 1257. This proposed amendment would create a tax exemption for new homebuyers specifically.

"Citizens should ask: Why are we exempting 'everyone' (including wealthy multi-home owners) when we should be targeting the relief to the First-Time Buyer? That is the 'Ladder' in action. If we move the relief to the person, not the property, we stop subsidizing the landlord."

The Dialogue: Closing the Barn Door Before the Cows are Gone

JaxBNimble: Gentlemen, we are in an election year. In a few months, the nuanced "Middle Ground" we've discussed will likely be flattened into partisan talking points for the primaries. But more importantly, certain administrative clocks are ticking. If we don't act now, the "clay" will harden for the next decade.

Specifically, I want to talk about the Opportunity Zone (OZ) 2.0 redesignation. Matt, am I correct that the Governor has a one-time window this year to set the map for the next 10 years?

Q1: The OZ 2.0 "Decade-Long" Deadline

Matthew Yglesias: You are 100% correct. Under the One Big Beautiful Bill Act of 2025, the federal OZ program was made permanent, but it requires a decennial redesignation.

"Governor DeSantis (or any Governor) must submit new OZ nominations to the Treasury between July 1 and September 28, 2026. Once those census tracts are certified, they are locked in until 2036. If we want to steer institutional capital toward vacant city-owned land or specific 'Build-to-Rent' corridors in Jax, those tracts have to be on that map by September. If we wait for the November election results to start the conversation, the barn door is already closed."

Dr. Jaffee: This is the ultimate "Strategic Alliance" moment. If Joshua Hicks and the City Council don't lobby the Governor's office now to include Jacksonville's distressed but high-potential tracts, we lose the primary tool for attracting the "Safe Harbor" capital we discussed.

"And there's a catch: OZ 2.0 has tighter rules. The median family income threshold dropped from 80% to 70%. We have to be surgical. If we let the state just 'pick the usual suspects,' we miss the chance to link these zones to our Homeowner Ladder."

Q2: The Constitutional "Point of No Return"

JaxBNimble: Beyond the OZ maps, we have the Property Tax Amendments (HJR 201–213). They are headed for the November ballot. Is this another case of "clay" hardening?

Dr. Jaffee: Absolutely. Once a constitutional amendment is passed by 60% of voters, it is nearly impossible to undo.

"If HJR 201 passes and eliminates non-school property taxes for homesteads without a replacement for local revenue, Jacksonville's 'Homeowner Ladder' becomes an unfunded dream. The time for Hicks and Peluso to negotiate a Legislative Alternative is during this session (Jan–March), before the ballot is finalized. After March, the candidates will be too busy running on 'Total Tax Repeal' to listen to a nuanced compromise."

Matthew Yglesias: And don't forget the Live Local Act sunset. While it was expanded, the "Preemption" window is a limited-time offer for developers. If the city doesn't set its local "Missing Middle" standards now, the state's default rules—which favor the developer over the community—will become the permanent reality of our skyline.

The JaxBNimble Takeaway

We aren't asking investors to be "nice." We are asking them to be rational. By creating a Tax Survival Plan that rewards Value Addition over Value Extraction, we align the interests of Wall Street with the interests of Main Street.

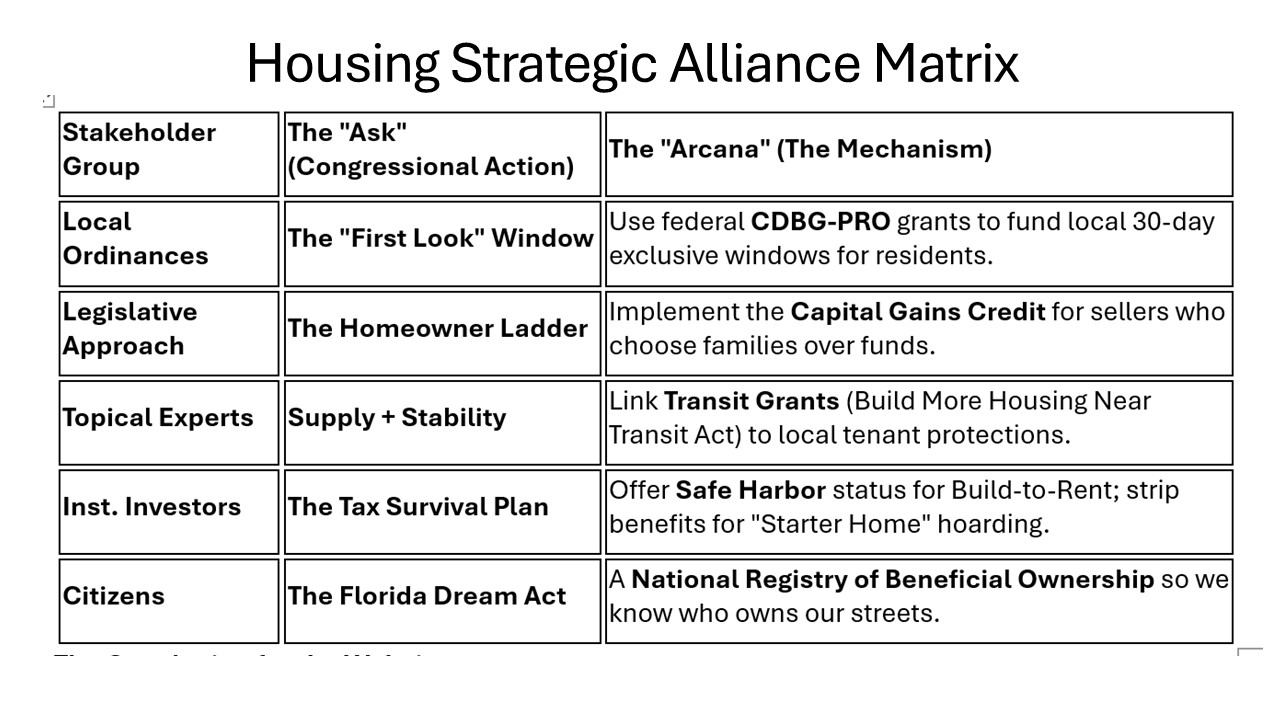

Stakeholder Briefs: The Strategic Ask Matrix

Based on this debate, here is the "Briefing Note" for citizens to use when engaging the five stakeholder groups:

JaxBNimble: The ROAD Act is the engine, but the Strategic Alliance Matrix is the steering wheel. We don't just need a "bipartisan bill"; we need a Market Correction that treats housing as a community foundation.

About Us

Welcome to our website. We are dedicated to providing clear, well‑structured information that helps visitors quickly understand who we are and what we offer. This section introduces our mission, values, and the overall purpose of our content. By organizing information into meaningful sections, we make it easier for readers to navigate, find what they need, and engage more deeply with our services.

Clear Headings & Subheadings

1. Introduction & Context

Open your page with a concise introduction that explains the main topic and why it matters. Use this section to set expectations for what readers will learn and how the content is organized. Keep paragraphs short and focused so visitors can quickly scan and decide where to dive deeper.

2. Main Themes & Categories

Group related ideas under clear, descriptive headings. Each main heading should cover one core theme or category. Within each theme, use subheadings to separate steps, perspectives, or use cases. This structure helps readers jump directly to the information that is most relevant to them.

3. Step‑by‑Step Explanations

For processes or instructions, break content into numbered steps with subheadings that summarize each action. Start each step with a short, bolded phrase that captures the key idea, followed by a brief explanation. This makes complex workflows easier to follow and reduces cognitive load for your audience.

4. Examples, Tips & Best Practices

Dedicate a section to practical examples and tips. Use subheadings like “Common Mistakes,” “Pro Tips,” or “Real‑World Example” to guide readers. This not only breaks up dense text but also highlights high‑value insights that visitors are likely to skim for.

5. Summaries & Key Takeaways

End major sections with a short summary under a clear subheading such as “Key Takeaways” or “In Summary.” Use bullet points to recap the most important ideas. This reinforces learning and gives scanners a quick way to grasp the essentials without reading every paragraph.

6. Next Steps & Further Reading

Conclude your page with a section that points readers to related content, downloads, or actions. Subheadings like “What to Do Next” or “Learn More” help transition from reading to doing. This final structure keeps long pages organized, approachable, and easy to navigate.